Liam Dillbeck | News Editor

October 23, 2024

When it comes to discussing the economy, it is crucial to be realistic, even if that entails a pessimistic outlook on life. These practices can directly influence millions of people and should be the topic of discussion more often. So, why are we not talking about student loans?

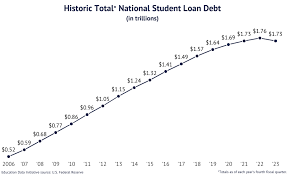

To clarify, why are we quietly observing the most absurd increase in student loan interest rates and debt? I get it, the 2020s have been relentless with their challenges towards the U.S., pandemic after war after the presidential election. Things can easily slide under the carpet, especially when our attention is elsewhere. But it is time to focus, especially as students.

Student loan debt has maintained its 1.7 trillion dollar value since 2021, and it shows little signs of decreasing. In fact, student loan interest rates have also been increasing dramatically in the last 5 years. According to Consumerfinance.gov, “Interest rates for undergraduate loans have increased to 6.53% this year, nearly a 19% increase over last year and a 44% increase from just five years ago.” So, not only is the country’s student loan debt getting worse, but the amount of money we continue to spend on loans will also increase.

To explain it at a more familial level, the average student loan debt in a Californian family is approaching $40,000. Depending on whatever job you take after school, it could potentially take 15, or more, years to fully pay off this debt. This factor has played a huge part in discouraging high school students from college. “I might just go to Saddleback, I don’t want to be walking around with that debt after school,” said Senior Liam Carrol.

Despite its aggressive tone, this article is not meant to scare you away from college, but rather suggest short-term solutions for this exponential problem. For the graduating students who are unsure if they can take on this debt, I would continue to consider future steps. As Senior Gavin Unger said, “College is an investment in yourself. You believe you’ll pay off the debt and more with that education and degree.” One obvious solution is to start saving. If you are hesitant to get a job, it is never too late. Depending on when you start, you could save up a large sum of money before graduating high school, allowing you to contribute to the payments. Another helpful characteristic is a college’s return rate. Colleges often advertise the percentage of graduates who can pay off their student loans. This statistic is a life changer, as it may allow you to look at more expensive colleges because you are more likely to return your investment.

Although the student loan debt seems to be too far gone to be saved, it should not prevent you from reaching a higher education. Sit down, with your parents, and see what is financially achievable for you. College is important, but being realistic is crucial.

Leave a Reply