Kate Hedger | Head Editor

April 29, 2021

These days, being able to go to college doesn’t just depend on a person’s grades, test scores, or extracurriculars anymore, it also depends on how much money a person has.

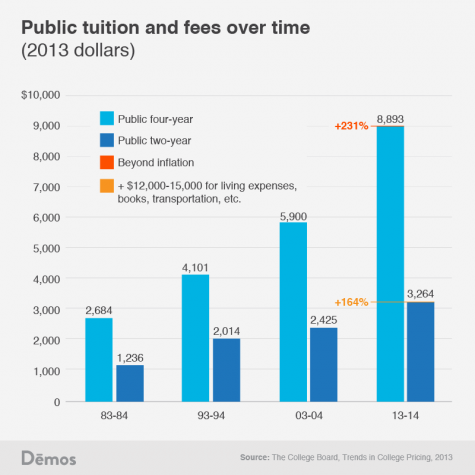

High school students who aspire to further their education are facing a real problem: Are they even able to afford college? There is no denying that the higher education system in America is flawed. Over the past two decades, the cost of college has skyrocketed. For example, out of state tuition for a prestigious UC (such as UCLA) has risen from about $7,000 to about $43,000 in just 30 years.

For students who can’t afford their dream college there are a few options. The first is to take out a loan that will have to be paid back after college. In this case, many people are left paying off their student loan debt well into their late twenties, thirties, or even longer. More than 45 million students have taken out student loans and these students contribute to a national total of $1.5 trillion in student loan debt.

“I am currently waiting on an appeal for my financial aid from BU,” senior Luke Huston said. “The place is absurdly expensive and the entire FASFA process is so problematic. Especially this year. It is based on tax returns from two years ago and those definitely do not reflect every family’s income.”

The second option is to go to a community college for two years and then transfer to a four year university. Even in this case it is possible to need to take out a loan in order to pay for those two years.

“Community college is a smart financial decision because you can reduce your debt while still getting a good education,” senior Aidan Tapias said. “I think going to a community college for two years and then transferring to a four year is beneficial because you get a good education and a degree while not having to pay as much.”

There is no reason people should have to face a financial barrier in order to get an education. Nobody wants to start their life drowning in debt, but for a lot of students, there is no other option. This isn’t how a functioning education system works. The way things are now, people with money can afford the most prestigious educations, and in turn, get the best paying jobs. In contrast, people who can’t afford a top university have a harder time getting high paying jobs, leading to their children facing the same struggles, and the cycle continues.

It’s easy to identify what the problem is, but it’s more useful to examine how we got here. The problem begins with the sheer number of people who are trying to obtain a college education. Financial aid programs have expanded and there is a need to increase school budgets for student services and faculty pay because of how many people want an education. This, combined with the lack of financial support from state governments, has made the cost of college skyrocket.

The question that’s probably on your mind is: How do we fix this?

It’s easy to get angry at the circumstances and point fingers, but in the long run, doing that won’t contribute to any type of solution. The problem with a topic like this is that there isn’t just one solution that every American can agree on. Some think all colleges should be free, some think the cost should be reduced, and some think that things are fine the way they are (rich people, more than likely).

Looking at European countries — such as Germany, France Ireland, or Sweden — where college is offered free, it is clear that there are other effective models for higher education. This “free” college isn’t technically free, given the fact that tax payers absorb the cost, but it is certainly eye-opening to see how other countries run things.

To anyone who wants to attend college at the lowest cost possible, I would encourage you to apply for financial aid, check out scholarship opportunities, take AP classes, and attend classes at a local community college. We can’t change the system overnight, but it’s important that we keep working towards a solution no matter how long it takes.

Leave a Reply