Jack Wolfsohn | Head Editor

March 3 2023

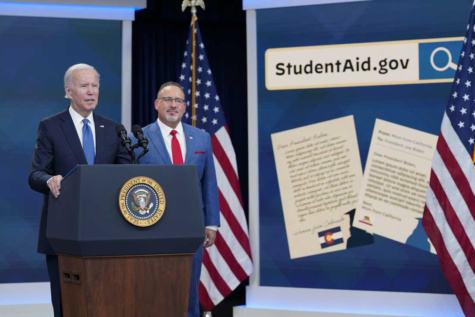

Student loan debt has become a significant issue in the United States, with borrowers owing over $1.7 trillion in federal and private student loans. In response, President Biden has proposed a student debt relief program that aims to provide targeted relief to certain groups of borrowers. However, the program includes several nuances that are important to understand.

The first key point of the program is targeted relief. Unlike blanket forgiveness of all student debt, the program is aimed at specific groups of borrowers. Specifically, those who attended for-profit colleges, historically Black colleges and universities (HBCUs), or other minority-serving institutions (MSIs) may be eligible for up to $10,000 in student debt relief. This approach is intended to address some of the structural inequalities in higher education, where students from marginalized communities are more likely to attend for-profit colleges that have a poor track record of student outcomes.

The second nuance of Biden’s student debt relief program is changes to income-based repayment plans. Under the program, monthly payments would be capped at 5% of discretionary income (down from the current cap of 10%) and any remaining debt would be forgiven after 20 years of payments. This is a significant improvement over the current income-based repayment plans, which can result in borrowers paying more over the life of their loan than they originally borrowed.

However, it’s important to note that any forgiven student debt may be considered taxable income. This means that borrowers could owe taxes on the amount forgiven, which could be a significant burden for those who receive large amounts of debt relief. To address this concern, the Biden administration has proposed waiving these taxes for borrowers who receive debt relief through its targeted relief program. This would be a welcome relief for borrowers who would otherwise face a hefty tax bill.

Senior Jessica Polanco said, “It would be great to see all these different aspects of student debt relief to be realized, but are they realistic?”

It’s worth noting that the timeline and implementation of the program are still uncertain. While the Biden administration has signaled its intention to provide student debt relief, it’s unclear how and when it will be implemented. It’s possible that the relief could come in the form of executive action, but it’s also possible that legislation will be required. Given the partisan divide in Congress, it’s unclear whether any legislation would be able to pass, particularly if it includes significant debt relief provisions.

While Biden’s student debt relief program is aimed at addressing some of the structural inequalities in higher education and improving the lives of borrowers struggling with student debt, it includes several important nuances that are worth understanding. The program is targeted relief for specific groups of borrowers, includes changes to income-based repayment plans, and may have tax implications. However, the specifics of the program are still uncertain, and it remains to be seen how and when the relief will be fully implemented.

Senior Christian McCleary said, “I’m worried that the Supreme Court may strike down anything regarding student debt relief on the grounds of being unconstitutional.”

The Supreme Court has not yet weighed in on the issue of student debt relief in a significant way. While there have been several cases that have touched on student loan issues, such as bankruptcy and loan forgiveness, the Court has not yet ruled on a case that directly addresses the question of whether the President or Congress has the authority to provide widespread student debt relief. However, the Court did issue a ruling in January 2021 that clarified the scope of the President’s authority to issue executive orders. In that case, known as Trump v. New York, the Court held that the President has broad discretion to issue executive orders related to policy areas under his purview. While the case did not specifically address student debt relief, it did affirm the principle that the President has significant authority to use executive action to address policy issues.

Leave a Reply